What is a total loss. Phone 7am to 10pm Call us on 1800 220 233 1860 500 3333.

How Long Does An Accident Stay On Your Insurance Experian

Collision insurance pays to repair or replace your car after an accident so without it you might have to pay out of pocket to replace the car.

. Write down details like. For you to get compensation from PD the. How much your car is worth.

Say Hi to 917678006000. To get an insurance payout for a car that is a total loss you must have either property damage liability PD or comprehensive or collision insurance in your policy. Get up to.

Your auto insurance is there to protect you from financial liability in case of a car accident but what if the accident happens when youre not driving your own car. Here are some of the risks a driver may face. After a car accident you may hope your insurer will restore your vehicle to its pre-crash condition so you can continue driving it.

The best advice is to never let an uninsured person drive your car because all damage will fall to your insurance policy and if your policy limits are exceeded all of your personal assets are now at risk. Your rental coverage kicks in if your vehicle is not drivable or if it is drivable once the vehicle is in the shop for repairs to begin. Visit today to know more.

It is favourable to opt for this policy to ensure optimum coverage for your vehicle and reduce financial liabilities. Damage to your vehicle and the at-fault vehicle. Ever stranded on the road not knowing what to do when your car breaks down unexpectedly.

Typically rental car coverage is applicable if you are repairing your vehicle through your policy which means the damage to your vehicle exceeds your deductible. Insurers take many factors into. Make sure nobody was hurt.

If your car is written off your insurer can pay you its agreed or market value. If the accident is your fault and you dont have collision insurance your best option is to sell the car in its current state. Insurance group ratings are advisory insurers dont have to follow them.

How to file an insurance claim if your car is totaled. Most new cars are assigned to an insurance group a rating between 1 and 50 that indicates the level of risk as seen by the insurers. You cause a minor collision when glare from the setting sun blinds you in rush hour traffic.

If the damage your friend causes exceeds your policy limits the injured party can come after you for medical and property-damage expenses. Rental is not applicable for drivable vehicles while waiting for your repair appointment. Injured passengers can usually make a claim under the no-fault policy of the driver of the vehicle in which they were riding at the time of the accident And then theres uninsured.

Enjoy up to 200 reimbursement when you sought roadside assistance services due to a non-accidental breakdown. You cause an accident. You will still be able to recover something through the salvage value.

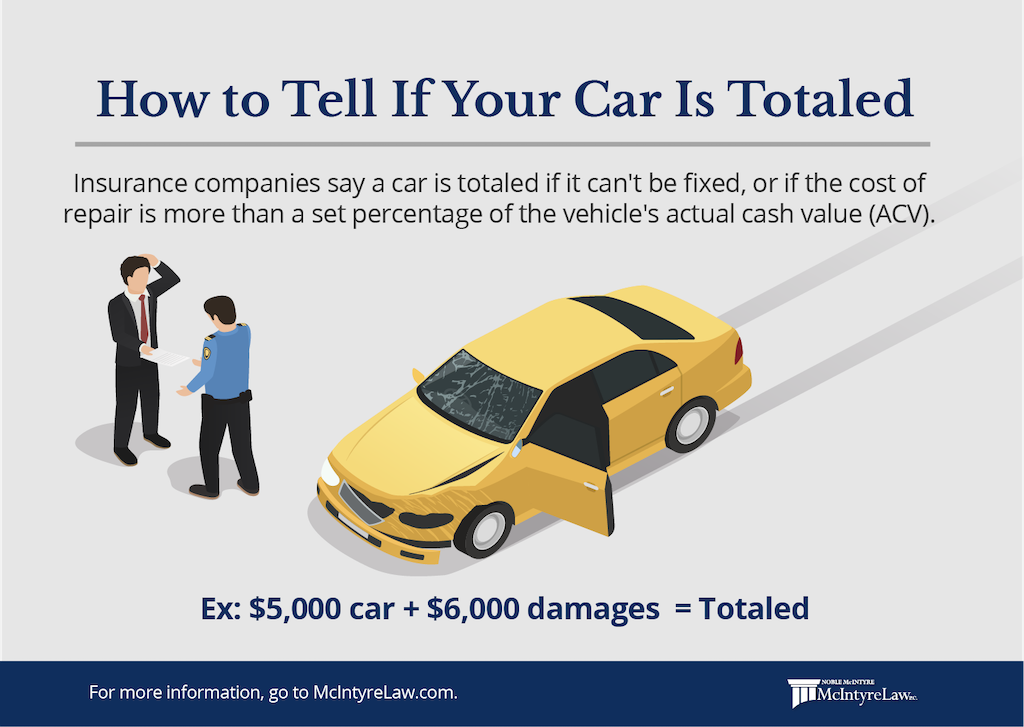

Then call the police. The insurer also needs to take into account things like providing a courtesy car and administration costs for instance. When a vehicle has been in an accident and the total damage exceeds a certain percentage of the value of the car ranging from 75 percent to 90 percent the insurance company will decide that it.

With a car crash happening according to the National Highway Traffic Safety Administration approximately every 60 seconds - or more than 5 million crashes per year - its likely you or someone you know will be involved and one. If youre changing your car youll want to think about the cost of insurance before you commit to buy. The insurance group rating is the key.

Non-owner car insurance only provides bodily injury liability and property damage liability coverages. If youre at fault in an accident your policys property damage liability coverage would help pay to repair the other drivers automobile. If youve been in a serious accident the insurance company will run calculations on how much it would cost to repair your car vs.

If youre involved in an auto accident regardless of fault and your car is damaged immediately notify your agent or insurance company. Simply add our new Roadside assistance and wellness cover1 at 856year to your Car Insurance to safeguard your journey. Call 1-800-665-5108 for a quote.

Sometimes its declared a total loss or totaled The term totaled means the cost to repair your vehicle is more than the car is worth. Remember its up to the insurance adjuster to determine whether. Toggle menu toggle menu path dM526178 313114L447476.

Total loss claims and actual cash value. A big exception is accidents in no-fault car insurance states where injured drivers will make a claim with their own car insurance companies regardless of who was at fault for the accident. Find out what to do next and how to get the most out of it.

In most circumstances employers are not responsible for the theft or damage to an employees property while working. You will need the record of the accident for the insurance company. That doesnt always happen.

Likewise if the other driver sustains injuries your non-owner bodily injury liability coverage could help pay their medical. Your insurer will write off your car if the damage is so severe that it cant be repaired or if the cost of repairing it is uneconomical. Employers have a duty to keep the work environment safe for employees.

This policy also includes car theft. Buy Renew Personal Accident Insurance Policy Online from Future Generali ensure financial stability with personal accident cover. At Progressive were available 247 to report a claim over the phone or online.

PD is mandatory in every state but the only way to receive a payout from it is to file a claim against another drivers PD. Some states have laws that require insurers to total a vehicle when the. Comprehensive Car Insurance Cover not just secures you against third-party liabilities it also offers insurance for your car in case of flooding accidents fire etc.

The first step in a property-damage-only accident is still like any other. If someone else causes an accident while driving your vehicle either with you in it or not your car insurance will likely cover damage to your car that the driver may have caused assuming. Thats the most important thing.

Property Damage Claims and Work Accidents. Learn what it means if your car is totaled and how insurance can help if your vehicle is deemed a total loss. They wont just calculate whether the cost of repair exceeds the cars market value the price it is likely to fetch if sold.

Find out your options if youve been in a car accident that wasnt your fault and how to make a successful claim on your insurance. Youll receive a check for the current cash value of the vehicle from your insurance company. And Farmers has coverage options that enable you to get the auto insurance policy you want.

Cars are typically totaled when the damage exceeds 65 or 70 of the cars market value. Make your own accident report too. No one likes to think about the possibility of crashing their car but knowing what to do when it happens makes the aftermath much easier.

Whatever you drive you know you need insurance for your car and assets. Workers compensation insurance covers employee injuries but doesnt cover their damaged personal property.

How Often Do Auto Accident Settlements Exceed The Policy Limits

How The Total Loss Of Your Car Is Determined After An Accident

What Happens When Your Car Is Totaled Mcintyre Law P C

Car Accident Not All Kinds Will Make Your Insurance Go Up Forbes Advisor

What To Do If Your Car Is Totaled After An Accident Adam S Kutner Injury Attorneys

What Happens If I Am At Fault For A Car Accident Car Accident Lawyers Ben Crump

When To File A Car Insurance Claim And When Not To Nerdwallet

How Often Do Auto Accident Settlements Exceed The Policy Limits In California Starpoint Law

0 comments

Post a Comment